Ever heard of the ‘Santa rally’? And no, it’s not a Father Christmas-themed motorsport… although that would be brilliant!

It’s a performance trend that investors have seen over the decades, where the stock market tends to increase in value around the end of the year. In this article, we explore this festive phenomenon and look at what it could mean for your investments.

What is the Santa rally?

We always say it’s important to ‘invest for the long term’, because over shorter periods, the stock market can be very volatile and month-to-month you can’t predict its peaks and pits. But zoom out a few decades and we start to see some patterns emerge for certain months which tend to fair better than others. And December is one of those months.

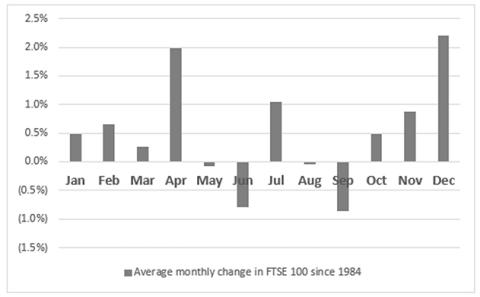

The so-called Santa rally is one of the most talked about stock market phenomenon because the figures can back it up. Since its launch in 1984, the FTSE 100 index has gained 2.1% on average in December. That’s the biggest average gain for any month, with April and July following up as the only others to deliver an average increase of over 1%.

Source: Refinitiv data

Why does the Santa rally happen?

We asked Russ Mould, AJ Bell’s Investment Director, to give us his thoughts on the truth behind the trend.

“Investors used to talk about ‘the January effect’, as professional fund managers put their investors’ cash to work and into the market in the new year. But since 2000, that hasn’t consistently been the case. It’s possible that the Santa rally has emerged because investors have looked to anticipate the January effect and price it in, or discount it.

“Another possible explanation is year-end ‘window-dressing’ by professional fund managers. They may put money into the market to generate a bit of extra positive performance to help appease investors and justify fees.”

Whatever the workings behind the Santa rally, it’s important not to get carried away with the hype. Financial analysts have identified many of these seasonal trends – or ‘calendar effects’ – which may or may not occur throughout the course of any individual year. However, a certainty you can rely on is that the market is fast moving, and trends can come and go.

What does it mean for the year ahead?

Sadly, the Santa rally usually lacks a little staying power. According to Russ, the seasonal market trend “isn’t certain to offer anything more than festive cheer, because it doesn’t seem to be a reliable indicator for the following year. If anything, some of the best Decembers have led to the most treacherous subsequent years. By contrast, some grim Christmases – 1985, 1990, 1994, 2002 and 2018 – have been followed by cheerful years.”

This pattern rang true again in December of 2024, where the FTSE 100 fell by 1.4%. However, this year the FTSE 100 has returned 18.9% so far.

The jury is still out on whether we’ll see a surge in the market this December, and how 2026 will respond in turn.

We can’t predict the future

Though the Santa rally is a real historical trend, it doesn’t predict future performance of the stock market or your investments returns. This Christmas, now you know about the Santa rally, why not watch with interest how the market moves? But don’t let it get in the way of the more important things.

Remember that the value of investments can change, and you could lose money as well as make it. Past performance is not a guide to future performance.

These articles are for information purposes only and are not a personal recommendation or advice.