While the gender wage gap has been a well-documented issue for decades, the gender investment gap has remained in the shadows despite putting women far behind men in financial security and financial literacy. However, a younger generation of women have refused to be sold short.

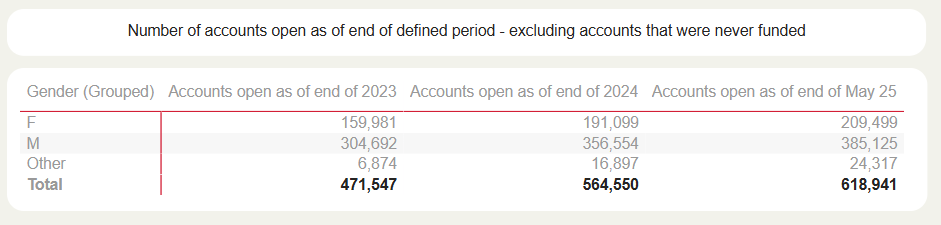

Women are still investing at a lower rate than men, but the number of women who invest is growing rapidly. In fact, AJ Bell has seen a 9.5% increase of women opening accounts in 2025 so far*, with the trend expected to continue.

However, financial literacy continues to be a barrier for all investors, and specifically young women.

A survey run by Capital One asked people ten basic questions around finance, including the benefits of an ISA, and compound interest. Women aged 18-24 had the lowest rate of financial literacy of any group, scoring an average 27.5% on their understanding questions. Men between the ages of 55 and 64 scored the highest, at 66.1%.

Across all age groups, women scored slightly lower than men on financial literacy, averaging 47.8% while men average 53.9%.

It’s worth mentioning that even with a slightly lower financial literacy rate, women, on average, outperform men with their investments by 1.8% annually, according to a study by Warwick Business School.

Some of this may come down to the strategies women take when they invest. On AJ Bell**, men trade about 12 times a year compared to 9 for the average woman. Plus, men are far more likely to invest in stocks over funds which is the opposite to women using AJ Bell. Could this back up the idea that women are focussing on longer-term goals whilst men pursue higher returns via stocks?

It’s promising that more women are beginning their investment journey, and even more promising that in general, the investment strategy is sound. But having the right tools to accompany you along the way can make a significant impact on how your investments perform. Without knowing the basics of how the UK system functions, for example using an ISA to protect investments from tax, this new group of investors could miss out on gains.

How can I learn more?

It’s not surprising that so many people, of all genders and age groups, struggle with financial literacy. It’s filled with acronyms and terms that are not used in everyday life. So unless it's something that you surround yourself with, it can be hard to wrap your head around.

Fortunately, there's a growing pool of resources to up financial knowledge. The trick is determining which of these are accurate and trustworthy.

Your investing platform should have good information to get you started on your investment journey. At AJ Bell, this can be found in the learn hub and through investment articles.

However, if you are looking for additional resources to help you invest, you need to make sure you can pick out the bad apples. One of the most important things to do when searching for information on investing is checking that your sources are reliable.

An increasingly popular way to gain investing information is through social media. ‘Finfluencers’, who are internet influencers that focus their content on finance, may pop up on your feed offering opinions on investments or advice. It’s important to be cautious when you come across these pages. Even if someone seems knowledgeable, they may not be qualified to give out guidance, or they may be an expert in a different market, like the US, where a separate set of regulations apply.

For young investors, this seems to be a growing industry. According to a study by the Chartered Financial Analyst (CFA) Institute, 38% of Gen Z investors in the UK cited social media as a major decision maker to invest.

While it’s encouraging that media has spurred an increase in investing, it doesn’t mean that those offering opinions on investments online are the right people to listen to. They also may not be acting in your best interest, as many of them are advertising financial products. In fact, three-quarters (74%) of Brits who have been guided by social media to make investment decisions have either lost money or experienced a negative effect on their credit score, according to research by Capital One.

Do I really need to worry about investing while I’m young?

Investing while you’re young can be a little bit of a Catch-22. If you invest now, your money will make the biggest impact down the line, because it has the most time to compound. But when you’re just starting your career, and attempting to pay bills for the first time, there may not be a lot of extra money floating around that you can invest. You also might not be sure what your future holds, and it’s hard to stay motivated when you aren’t sure what exactly you’re investing for.

Investing can seem like another financial stressor, and one that you can easily look past. But creating the habit of investing young is also a great opportunity. Even just an extra five or ten years in the market will make a dramatic difference once you reach retirement years. You’ll also be creating a habit that many don’t adopt until later in life when they’re juggling families and mortgages.

Regardless of what life has in store, having savings gives you freedom. It can allow you to take on new opportunities now and ease worries about the future.

*AJ Bell platform data comparing accounts opened by women on 31/12/2024 and 30/05/2025

**AJ Bell platform data 01/01/2024 - 31/12/2024

These articles are for information purposes only and are not a personal recommendation. We don’t offer advice, so it’s important you understand the risks, if you’re unsure please consult a suitably qualified financial adviser. The value of your investments can go down as well as up and you may get back less than you originally invested.